Uniswap Exchange Review 2024: What To Know, Pros, Cons, & Features

Our Take On Uniswap

THE BOTTOM LINE:

Uniswap, crypto’s leading decentralized exchange, is a good fit for both experienced crypto traders and beginners. But newbies should pay special attention to the price impact on trades. Fortunately, Uniswap lets you know if the price impact of your trade is high. I found the platform easy to use, and overall, give Uniswap two thumbs up for user experience, UI, and features. Read our full Uniswap exchange review to learn more about the pros, cons, and our first-hand opinion.

Pros

Pros

- Easy-to-use interface

- Low-cost trades

- No KYC or AML requirements

- Trade or earn by providing liquidity

- Multiple blockchain networks supported

Cons

Cons

- Can be intimidating for beginners

- Higher fees when purchasing through MoonPay

- High gas fees on the Ethereum network

Full Uniswap Exchange Review

| Swap Fees | Purchase Fees (MoonPay) | Number Of Cryptocurrencies | Availability | Hacks/Exploits | Code Audits | Smart Routing |

|---|---|---|---|---|---|---|

| Uniswap charges a 0.01%, 0.05%, 0.3% (most common), or 1% fee on swaps. These fees are paid to liquidity providers who supply tokens on the platform. | 2.55% U.S. Debit Cards / 3.25% U.S. Credit Cards (Fees differ internationally) | Uniswap supports thousands of ERC-20 tokens, an ever-growing market segment. | Uniswap is available to traders worldwide. | Uniswap has never been hacked. | ADBK completed an audit for Uniswap Version 3 in March 2021. | Uniswap uses smart routing, so the platform can split your order between multiple pools or add additional hops to get you the best price. |

What Is Uniswap?

Uniswap is a decentralized exchange, meaning it’s not run by a company like Coinbase or Gemini. Instead, users govern the platform using the UNI token that makes token holders eligible to vote on proposed changes to Uniswap. Users swap through Uniswap liquidity pools, which are groups of tokens made available by other traders.

The Uniswap app is designed and maintained by Uniswap Labs, a New York company, but the protocol itself is governed by the community. Hayden Adams, the founder of the Uniswap protocol and CEO of Uniswap Labs, is regarded as a thought leader in crypto and often tweets his take on industry happenings.

Uniswap was first built for Ethereum, using smart contracts to provide exchange functionality. Smart contracts work like a series of switches: If this happens, do that, and then move on to the next switch if needed.

Now, Uniswap offers support for Ethereum-compatible networks like Polygon and Optimism. These networks bring lower-cost transactions, sometimes slashing transaction costs to pennies.

Swaps are limited to ERC-20 tokens, a token standard for Ethereum. When you make a swap, the funds are placed in your wallet. No extra steps or withdrawal fees.

To date, nearly 5 million unique wallet addresses have used Uniswap, surpassing $1 trillion in trading volume since its inception.Read More

Key Features

Uniswap isn’t unique. There are plenty of other DEXs that work similarly, but what it does offer is a simple interface that serves as an entryway to a vast world of cryptocurrencies.

- Broad token selection: Uniswap’s size attracts more types of tokens than many smaller DEXs.

- Simple user interface: Google built its business on a simple search box that delivers an ocean of information. Uniswap brings similar simplicity to the world of crypto trading. Advanced features are just a click away.

- Deep liquidity: Uniswap’s market position attracts deeper liquidity pools, which means prices are less likely to move significantly for larger swaps.

- Buy NFTs: Uniswap acts as an NFT aggregator, bringing a searchable assortment of NFTs from top marketplaces.

Uniswap Fees

| Fee Type | Fees |

|---|---|

| Network fees | Vary by network, with ETH being costlier for transactions compared to Polygon (MATIC) or others |

| Swap fees | 0.01%, 0.05%, 0.3%, or 1% |

| Purchase fees (MoonPay) | 2.55% US Debit Card, 3.25% US Credit Card (Fees differ internationality) |

Uniswap’s trading fees compare well with centralized exchanges like Coinbase. Most swaps on Uniswap cost 0.3%, whereas Coinbase Advanced charges 0.6% for market orders if your 30-day trading volume is under $10,000.

However, swaps can get costly on Uniswap if you’re using the Ethereum network and gas prices spike during high network usage. Fortunately, you can choose less expensive (and faster) networks like Polygon.

Expert Review Of Uniswap

I put Uniswap to the test and found most features of the app easy to use.

For this Uniswap exchange review I used the MetaMask wallet, a multi-blockchain wallet that can automatically detect new tokens. Fees can get pricey on Ethereum Mainnet, so I used the Polygon network.

Uniswap supports Ethereum, Polygon, Optimism, Arbitrum, and Celo networks, all of which are also supported by MetaMask. However, some actions require the Ethereum Mainnet, as I discovered when shopping for NFTs on Uniswap.

For swaps and funding liquidity pools, Polygon works well on Uniswap. It also costs less than the Ethereum network and provides near-instant transactions.

Funding

You can add crypto assets to your Uniswap-connected wallet in two primary ways: Send it from an exchange (or another wallet) or buy assets on Uniswap’s platform using a third-party provider.

In the US, Uniswap partners with MoonPay, a provider that supports a number of tokens, including ETH, MATIC, and USDC. MoonPay’s available assets vary by blockchain, however.

| MoonPay | Fees | Minimum |

|---|---|---|

| Card-based | 2.55% – 3.65% Depending on Location | NONE |

| Bank deposit | 0.99% | NONE |

I used Coinbase Advanced to buy some USDC, transferring the tokens over the Polygon network from my Coinbase account to MetaMask.

Swaps

Swapping cryptocurrencies on Uniswap proved painless and intuitive. Uniswap reads the balances in your connected wallet, so you’ll see available token balances as you choose your trade.

I swapped some USDC stablecoin for MATIC. Uniswap passed the transaction over to MetaMask for authorization.

Swap fees vary depending on the cryptocurrencies you’re trading and the fees chosen by the liquidity providers. On Uniswap, you can trade (swap) – or provide liquidity by depositing crypto into a smart contract in a matched pair, such as MATIC and WETH.

| Pair | Swap Fees |

|---|---|

| Very stable pairs | 0.01% |

| Stable Pairs | 0.05% |

| Most pairs | 0.3% |

| Exotic Pairs | 1% |

When making swaps, however, Uniswap doesn’t make these numbers obvious. Instead, the app displays the best price for you. A drop-down box details the expected output from the trade (how much of Token B you’ll get for Token A).

Waiting to trade for a few seconds could result in a higher or lower output.

Uniswap displays both the token quantity and the value in fiat, but fiat prices can take a while to load.

Tokens

Uniswap offers a list of top tokens by blockchain, showing 100 popular tokens under Ethereum Mainnet, but just 82 under Polygon. The Celo network displays only eight tokens. The top tokens list serves as a handy way to gauge trading activity.

Token stats include:

- Total Value Locked (TVL)

- Trading volume

- Price

- Price change

- Price charts

The top token lists don’t show every token on Uniswap, however. You can find more obscure tokens using the search box in the swap screen if some industrious traders have funded a liquidity pool.

Uniswap displays a warning if the token is unavailable on leading exchanges. For example, I saw this message when searching for stETH (staked ETH).

NFTs

Uniswap aggregates NFTs from several marketplaces, including Opensea, the leading NFT marketplace. You can even buy property NFTs for the Decentraland metaverse. In June of 2022, Uniswap Labs acquired Genie, a startup NFT aggregator. Then they combined the tool with Uniswap’s core tools, bringing more value to users.

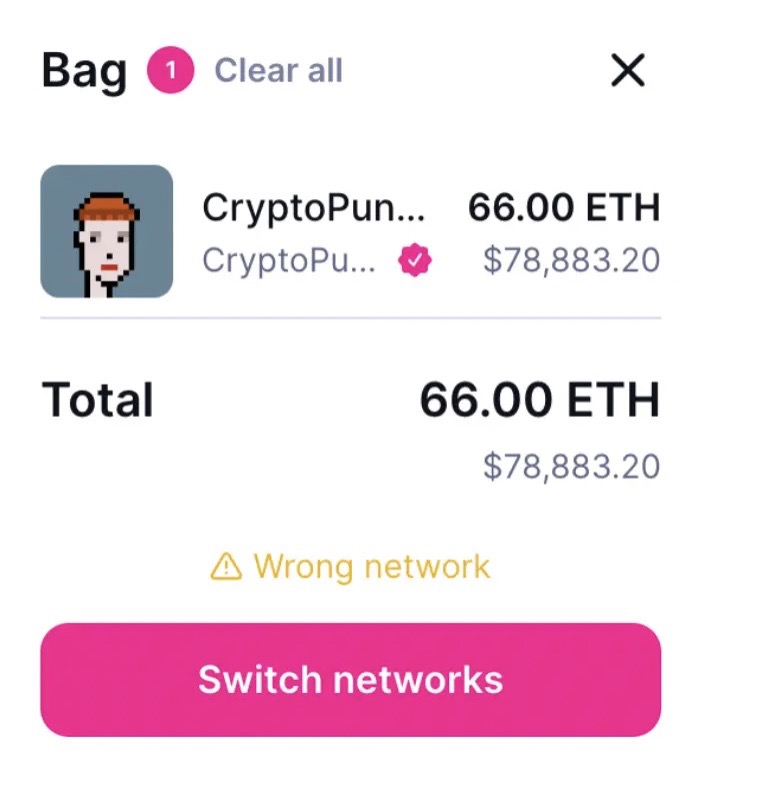

While alternative networks like Polygon work well for swaps and liquidity pools, I quickly discovered that buying NFTs on the platform requires that you use Uniswap with the Ethereum Mainnet.

Attempted purchases with Polygon were greeted with a message stating, “Wrong network.”

I also didn’t have 66 ETH in my wallet. Maybe next time, CryptoPunks.

Currently, Uniswap offers NFTs from the following platforms:

- OpenSea

- X2Y2

- LooksRare

- Sudoswap

- Larva Labs

- X2Y2, Foundation

- NFT20

- NFTX

Uniswap Liquidity Pools

We had to include the liquidity pools feature in this Uniswap review. It’s one of the best features that offers opportunity for token holders to earn a return by funding liquidity pools.

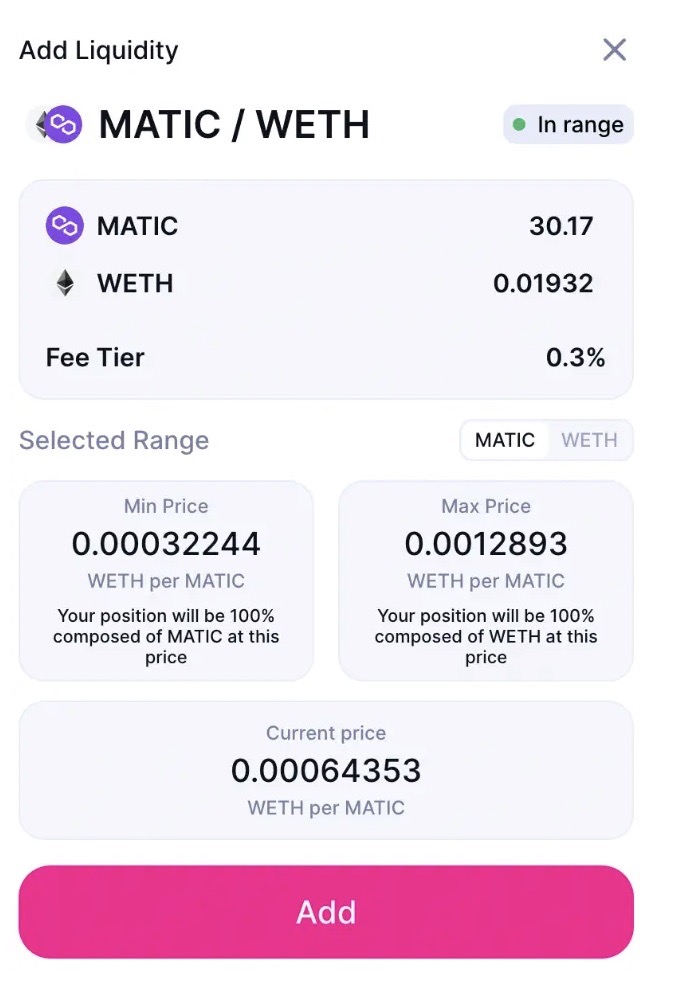

In a liquidity pool, you deposit paired tokens in equal value based on the exchange rate.

For example, I deposited 0.01932 WETH along with 30.1711 MATIC.

Uniswap lets you define a price range, preventing trades outside that range. If you choose a common pair and fee, Uniswap selects a default price range you can modify.

Within seconds (using Polygon), I added liquidity to the pool, earning 0.3% when someone used the pool to swap tokens. Closing a position is just as quick.

Liquidity pools attempt to keep the balance of the pool at a 50-50 ratio for paired assets. Uniswap’s Automated Market Maker (AMM) algorithm raises the price of in-demand tokens if there is more buying pressure for one of the tokens in the pair.

In my own experience providing liquidity on Uniswap for a few days, the asset values tracked the outside market closely, increasing the value of my position as the crypto market rallied. Fees from trades added to the value as well, although the numbers were small.

Uniswap Vs. Centralized Exchanges

I found Uniswap’s exchange easier to use than centralized exchanges like Coinbase. Even as an experienced user, today’s exchanges can be overwhelming, with endless menus to dig through.

Uniswap uses one simple menu and search bar, giving a more streamlined experience. Uniswap’s fees also compare well with centralized exchanges.

Where I felt limited in comparison to centralized exchanges was in the selection of tokens. For example, because Uniswap only supports ERC-20 tokens, you can’t swap MATIC for BTC. You’d have to use WBTC (wrapped Bitcoin) instead. With Coinbase, I can trade MATIC for real BTC.

Customer Support

Uniswap offers two support options: a ticket system and a discord server.

I found the discord server impossible to navigate. Maybe I need to ask my teenage son for help.

Instead, I opened a ticket to ask a question about how to view liquidity pool starting deposits. Within an hour, I received a reply by email. The response spoke to someone already knowledgeable about the space (a fair assumption given the question), pointing me to Uniswap Info and external DEX explorers (which may or may not be accurate).

After some blockchain digging, I found the numbers I needed. Beginners may not fare as well, but I can’t fault Uniswap for that – and I did get a speedy reply.

Thanks, Uniswap!

Who’s Uniswap For?

- People who trade in volume: Uniswap attracts larger liquidity pools, which allow larger swaps with a lower price impact compared to smaller pools. Uniswap’s smart router can also split trades across multiple pools to get the best price possible.

- People who need tokens not traded on exchanges: Many project launches involve tokens that aren’t traded on most centralized exchanges, like Coinbase or Kraken. Instead, these tokens get their start through liquidity pools like those found on Uniswap.

- People who want to earn a yield: You can provide liquidity on Uniswap in just a few clicks, and the platform lets you set a tight trading range (concentrated liquidity) to maximize earnings while minimizing risks from impermanent loss.

Who’s It Not For?

- People who need coins and tokens outside the Ethereum ecosystem: If you need Bitcoin or Solana, you won’t find these cryptos on Uniswap. You’re limited to Ethereuem and ERC-20 tokens.

- People who need to buy with fiat: Uniswap does offer a way to buy tokens with USD or other fiat currencies. However, it can be spendy to buy this way. Many centralized exchanges offer more inexpensive ways to buy crypto with fiat.

- People who aren’t comfortable with crypto wallets: Apps like Uniswap require getting familiar with crypto wallets and how they work. Centralized exchanges hold your crypto for you, but Uniswap requires funds in a wallet you control.

Uniswap Alternatives

A Uniswap exchange review wouldn’t be complete without some alternatives. A handful of decentralized exchanges (DEXs) compete for the top slot, each bringing its own benefits.

Uniswap Vs. PancakeSwap

Where Uniswap focuses on just-the-swaps simplicity, PancakeSwap brings more features, including futures trading with perpetual swaps, yield farming, trading competitions, and more. Some of PancakeSwap’s features are only available on the BNB network.

| Platform | Fees | Supported Networks | Notable Features |

|---|---|---|---|

| Uniswap | 0.01% to 1%, with most swaps at 0.3% | Ethereum, Polygon, Optimism, Arbitrum, Celo | Swaps NFT marketplace Liquidity pools |

| PancakeSwap | 0.25% | Ethereum, BNB Chain, Aptos | Swaps Perpetual swaps (futures) Yield farming NFTs Liquidity pools Trading competitions |

Uniswap Vs. SushiSwap

SushiSwap mimics Uniswap’s simple interface but brings a few extra goodies without adding clutter. One particularly interesting feature is the ability to swap tokens across blockchains. For example, you can swap ETH on the Abitrum network for USDC on the Ethereum network. The downside: you’ll likely pay a price penalty compared to same-network swaps.

| Platform | Fees | Supported Networks | Notable Features |

|---|---|---|---|

| Uniswap | 0.01% to 1%, with most swaps at 0.3% | Ethereum, Polygon, Optimism, Arbitrum, Celo | Swaps NFT marketplace Liquidity pools |

| SushiSwap | 0.3% | Ethereum, Arbitrum, Avalanche, Polygon, Optimism, and others | Swaps Cross-chain swaps Liquidity pools Extra perks for SUSHI token holders |

Uniswap Vs. Balancer

Balancer also simplifies the swap experience, with one notably newbie-unfriendly difference: Opening the dApp on Balancer dumps you on a list of pools rather than the swap interface. Balancer offers fewer tokens than Uniswap, but many traders who provide liquidity prefer Balancer because it uses an 80/20 ratio for pool tokens, which helps reduce impermanent loss.

| Platform | Fees | Supported Networks | Notable Features |

|---|---|---|---|

| Uniswap | 0.01% to 1%, with most swaps at 0.3% | Ethereum, Polygon, Optimism, Arbitrum, Celo | Swaps NFT marketplace Liquidity pools |

| Balancer | 0.0001 to 10% | Ethereum, Arbitrum, Polygon, Gnosis | Swaps Liquidity pools |

Other NFT Marketplace To Consider

Is Uniswap Safe To Use?

We didn’t want to create a Uniswap review without a thorough understanding of its safety. Uniswap’s code has been audited, but there are no guarantees at all. While millions of users have swapped tokens on Uniswap, someone could discover an exploit tomorrow.

If you’re making swaps, the funds don’t leave your wallet until you approve the transaction. However, if you’re providing liquidity, you’re locking your tokens in a smart contract, and that’s where there’s a larger risk due to potential exploits. The same is true for any decentralized exchange.

We look into a variety of information and signals to determine how safe Uniswap could be to use. Check out the drop downs below for more information on the history and safety of Uniswap.

Note: In crypto, it’s always best to do your own research and use apps you feel comfortable using.

Uniswap was founded by Hayden Adams. Prior to founding Uniswap, Hayden Adams worked as a mechanical engineer at Siemens. Hayden Adams shares his takes on industry happenings with his Twitter followers and is regarded as a thought leader in the industry.

Uniswap was founded in November 2018.

Uniswap Labs has its headquarters in New York. Uniswap, the protocol, is a decentralized application that runs on the Ethereum blockchain.

Uniswap has raised $176 million in total through two funding rounds.

- August 2020: $11 million

- October 2022: $165 million

Uniswap’s first funding round was led by Andreessen Horowitz, a venture capital firm, while the larger funding round was led by Polychain Capital, an investment firm focused on blockchain assets. Uniswap’s funding rounds included numerous investors, including SVA (an angel venture fund), which participated in both funding rounds, and Paradigm, which participated in the second and larger funding round.

Uniswap Labs is a business registered in New York. However, Uniswap Labs builds products adjacent to the Uniswap open-source protocol, a decentralized application governed by a Decentralized Autonomous Organization (DAO). The protocol users interact with to make swaps or provide liquidity is not licensed anywhere. It exists on the blockchain as software anyone can use where allowed by local regulations.

Uniswap is not licensed as an exchange as would be required for centralized exchanges like Coinbase or Kraken.

Uniswap was audited in March 2021 by ABDK. Crypto audits done by crypto audit companies like ADBK test smart contracts for potential vulnerabilities. Project teams typically have a chance to address problems with the protocol before a finalized audit and launching of the app for users. Crypto apps that have not been audited by third parties may bring additional risk to users due to intentional or unintentional security holes.

No, Uniswap does not have proof-of-reserves because it is not providing custody of assets as you would find with a centralized exchange. Instead, users who provide liquidity on Uniswap or similar protocols are locking the assets with a smart contract – which they can exit at any time. Proof of reserves is a process often used for custodians or centralized crypto platforms that hold crypto on behalf of users.

Uniswap has never been hacked. In some cases, lost funds reportedly resulted from phishing, which gave access to the funds controlled by certain wallets that had funds locked in the Uniswap protocol.

No, Uniswap Labs has never been involved in bankruptcy. The Uniswap protocol isn’t subject to bankruptcy because it’s not a person or a business. It’s software.

There’s no indication that Uniswap has ties to companies with bad reputations. The Uniswap code is open-source software, meaning other projects can fork the code to build an app with similar functionality. This can create room for confusion, but what external projects do with the code should be judged apart from Uniswap.

Uniswap is well-regarded by millions of users worldwide but has its detractors as well. Users who posted their takes on TrustPilot gave Uniswap 1.6 stars out of 5. However, it’s also important to apply discernment. Decentralized applications like Uniswap come with a learning curve, and users who’ve had difficulty may be more likely to post a negative review.

To Sum It Up

Decentralized exchanges like Uniswap can still be easy to use. Depending on what you need to do, they might be easier to use than centralized exchanges like Coinbase, Gemini, and others.

As an added benefit, you can keep your crypto in your own wallet rather than trust a centralized exchange. NFTs and the ability to earn with liquidity pools add to Uniswap’s value. As a caveat, it can be more difficult to track your trades when compared to centralized exchanges.

Frequently Asked Questions

Yes. One risk is impermanent loss when providing liquidity. Impermanent loss refers to when the value of your investment in the liquidity pool falls below the value it would be if you had just held the tokens without providing liquidity.

Each exchange serves a different purpose. If you want to buy BTC or Cardano (ADA), you won’t find those cryptocurrencies on Uniswap. However, Uniswap can be a better choice if you need to exchange Ethereum-based tokens.

Low swap fees, selection, and anonymous trading are just some of the aspects of Uniswap that make the exchange an attractive option. Liquidity pools also offer a strong income opportunity when providing liquidity at scale.

Yes. Uniswap is available to US citizens. No proof of identity or residency is required.

Uniswap Labs, the company that maintains the platform, is based in New York, NY, USA. The exchange transactions, however, live on the Ethereum blockchain.

Uniswap returns trading fees to liquidity providers but can keep a small amount of these fees if community governance votes to enable fee sharing with the treasury. Uniswap also issues the UNI (governance) token, which currently has a market cap of over $4 billion, and engages in fundraising to fuel development.

When you use Uniswap, you’re using funds in your own wallet. Transactions also settle in your own wallet. Here’s how to connect MetaMask, one of the most popular crypto wallets.

Read our full MetaMask Review.

Step 1: Download the MetaMask Wallet.

Visit MetaMask to get the download link for the Chrome extension. MetaMask also offers a mobile version for Android and iOS devices. We’ll use the Chrome extension in this example.

Step 2: Create a new wallet.

Follow the on-screen instructions to set up your wallet for first use. MetaMask will generate a 12-word recovery phrase. Write this down and store it safely. Create a password as well (and write it down).

Step 3: Choose your network.

MetaMask supports Polygon and Optimism in addition to Ethereum. Both alternatives offer lower transaction costs. However, some features, such as NFT purchases, are limited to Ethereum.

Step 4: Fund your wallet.

You can transfer your crypto from another wallet or an exchange like Coinbase.

Step 5: Connect to Uniswap.

Visit Uniswap and click on Launch App in the top-right corner. In the app, click on Connect Wallet, again in the top right corner. Click on the MetaMask icon in the list (center screen) and accept the connection in your MetaMask wallet.

Uniswap also works with several other popular wallets, such as:

- Trust Wallet

- Coinbase Wallet

- Brave Browser Wallet

- Ledger Live (requires WalletConnect in the Ledger Live App)

- WalletConnect-compatible wallets