Coinbase Review 2024: Fees, Pros, Cons, & Safety

Our Take On Coinbase

THE BOTTOM LINE:

Coinbase is the first stop on the crypto journey for many investors, and with good reason. The Coinbase exchange offers a wide selection of cryptos, easy point-and-click purchases, and a myriad of payment options. The company also has a reputation for high fees — but that’s only partially true. In my Coinbase review, I found the exchange easy to use, although not as intuitive as some competing exchanges. I also found some effective ways to tame those infamous Coinbase trading fees.

Pros

Pros

- Coinbase doesn’t lend your crypto

- Shared balance for basic or advanced trading

- More than 250 cryptos available to trade

- Liquid ETH staking with cbETH token

Cons

Cons

- High fees for basic trades

- High fees for card-based deposits

- Limited staking options

Full Coinbase Review

| Trading Fees | $0.99 up to $2.99 (up to $75 trades), variable above $75 + spread, 0.4% maker and 0.6% taker fees on Coinbase Advanced |

| Staking Options | Ethereum, Solana, Cardano, Cosmos, Tezos |

| Trading Pairs | 500+, including ETH/USD, BTC/USD |

| Borrowing | Bitcoin-backed loans of up to $1 million |

| Coinbase App | Android, iOS, web app |

| Availability | 100+ countries, including the US |

| Insurance | Crime insurance, pass-through FDIC insurance on cash deposits |

What Is Coinbase?

Coinbase is a publicly-traded crypto exchange headquartered in San Francisco, CA. The Coinbase exchange dates back to 2012, three years before Ethereum hit the crypto scene, making Coinbase one of the most-established crypto exchanges out there. Today, Coinbase boasts over 110 million users worldwide, making it the largest US-based crypto exchange and second only to Binance worldwide when measured by trading volume.

Being a publicly traded company (NASDAQ: COIN) brings more transparency than you might find with privately held companies or exchanges headquartered in other parts of the world. Quarterly reports and SEC filings are available for review, making some crypto investors more apt to trust Coinbase over other options.

How Does Coinbase Work?

The Coinbase exchange offers a simple way to buy crypto, several staking options to earn a yield, a crypto rewards card, and advanced trading. A new Coinbase One subscription option provides no-fee trading, while Coinbase Advanced brings lower fees without a subscription.

Centralized exchanges like Coinbase provide a fiat onramp where buyers can buy crypto with USD or other currencies while also offering an online marketplace where sellers and buyers can trade crypto in a safer way. Coinbase security features like cold storage for crypto and two-factor authentication (2FA) help enhance buyer safety.

Key Features

Coinbase fills a niche for safety-conscious beginning investors but also offers several reasons to stay once you gain some crypto trading experience.

- Buy/Sell/Convert: Easy access to buy and sell crypto or swap crypto A for crypto B with a Buy & Sell widget found throughout the site and Coinbase app. Watch out for those fees, though.

- Coinbase Advanced Trading: Save on Coinbase trading fees and access charts and indicators through Coinbase Advanced, just two clicks away from the home screen.

- Learning Rewards: Earn free crypto for learning about newly launched tokens. Complete an easy quiz (or three) and get free crypto sent to your Coinbase account.

- Coinbase Staking: Stake popular cryptos like ETH or SOL to earn staking rewards.

- Liquid ETH Staking: Coinbase’s new cbETH token provides you with staking yield and the ability to sell or trade your staked ETH at any time.

- Bitcoin-Backed Loans: Borrow against your BTC with up to 40% LTV loans (and low-interest rates, typically under 9%).

- Coinbase One: Save on trading fees with a $30 monthly subscription, well-matched to frequent or high-value traders. Coinbase One offers free trades for up to $10,000 in monthly trading volume.

- Coinbase Card: Choose a new monthly reward to earn crypto on purchases with the Coinbase crypto-funded debit card.

- Coinbase Wallet & Web3 Wallet: Coinbase Wallet is a standalone product, but it lets you access your Coinbase account to buy crypto on the go. Coinbase’s web3 wallet is built into the Coinbase app for mobile devices.

- Recurring Buys: Coinbase lets you put your crypto buys on autopilot at daily, weekly, twice-monthly, and monthly intervals.

Coinbase Fees

| Fee Type | Coinbase Fees |

|---|---|

| Coinbase Trading Fees (Simple) | $0.99 up to $2.99 (up to $75 trades), variable above $75 + spread |

| Coinbase Trading Fees (Advanced) | 0.60% Taker (market orders) 0.40% Maker (limit orders), lower fees available with higher 30-day trading volume |

| Account Deposit Fees | ACH: free; Wire: $10 incoming, $25 outgoing; debit: $3.99%; PayPal deposit: 2.5% |

| Coinbase Withdrawal Fee | None, except by wire transfer ($25) |

The most affordable way to trade on Coinbase is to use Coinbase Advanced. The simple trade box on the home page can be costly; we’ll break down the fees later in the Coinbase review.

Cryptocurrencies Available On Coinbase

Coinbase offers over 250 cryptos, including BTC, ETH, SOL, ADA, and many other top cryptocurrencies. However, it’s hit or miss with some smaller projects and newer tokens. This isn’t necessarily a bad thing. You can buy these tokens elsewhere, and the move forces newer users to think twice before buying the latest hot token making the rounds on Twitter.

| Supported Cryptos | Not Offered |

|---|---|

| BTC, ETH, SOL, ADA, DOGE, LTC, DOT, USDC, USDT, and hundreds more. | XRP, TRON, HEX, PEPE, BNB, GMX, BUSD, and other smaller projects or competitor tokens. |

Expert Review Of Coinbase Exchange

Every time I visit Coinbase, I find something new. Throughout this Coinbase review, I’ll explore all those new things (and a few old things), so you can decide if Coinbase fits the way you do crypto. And if you’re new to Coinbase, you might pick up a few tips on how to use Coinbase in the most efficient way to build your crypto stack.

Let’s dive in.

Account Setup

Coinbase is a KYC exchange. KYC stands for Know Your Customer, which refers to regulations that require Coinbase and similar financial institutions to collect identification information from its customers. Expect to send a picture of your driver’s license or passport. Signing up and completing KYC is free.

Deposits

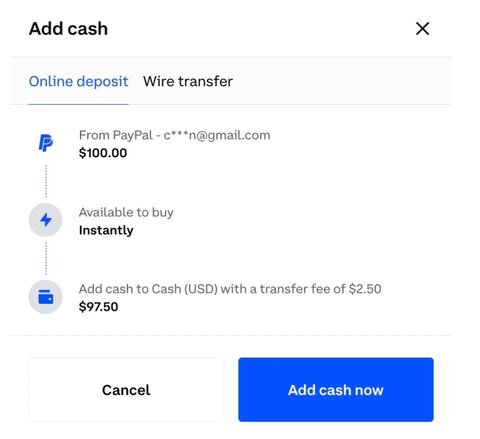

Like other exchanges, Coinbase supports ACH bank transfers, debit cards, and wire transfers. Where Coinbase is a bit different is in its support for PayPal deposits and purchasing crypto funded by your PayPal balance.

ACH transfers are free (but slow due to settlement time). Debit card transactions cost 3.99%, and PayPal deposits cost 2.5%.

ACH is the way to go here if you need to keep costs down, but many folks, especially freelancers, have funds available in their PayPal accounts. Kudos to Coinbase for offering the option. Few exchanges do. In my own tests, it appears that both PayPal and debit card deposit fees are waived when you use the Buy & Sell box (but trading fees are higher than with advanced trades).

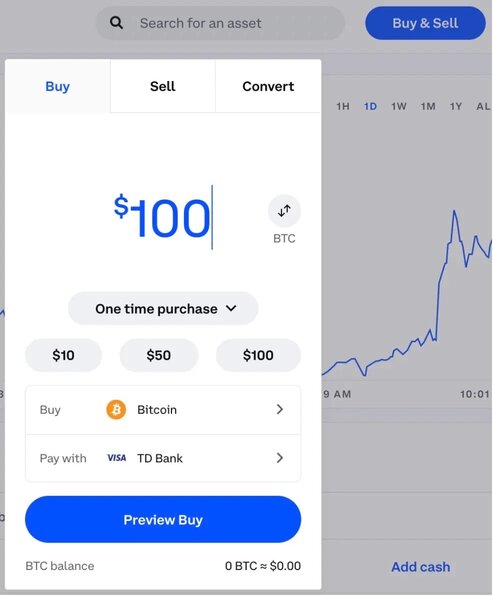

Simple Trades

On most dashboard pages, there’s a big blue button inviting you to buy or sell crypto. You can also convert from one crypto to another. Be careful with this one. The Buy & Sell box is convenient — but costly. How does Coinbase make money? It probably has a lot to do with this devilish Buy & Sell box.

Coinbase fees for simple trades are much higher than you’ll pay for Coinbase Advanced, covered in just a bit.

Here’s what you’ll pay for simple trades:

| Purchase Amount | Coinbase Transaction Fees |

|---|---|

| Up to $9.99 | $0.99 |

| $10 up to $24.99 | $1.49 |

| $25 up to $49.99 | $1.99 |

| $50 and up | $2.99 and up |

Above $75, Coinbase fees become less predictable as a fixed dollar amount but seem to be just under 4%.

Here’s what I saw on my trade previews:

| Trade Amount | Coinbase Fees | Percentage Of Trade |

|---|---|---|

| $10 | $0.99 | 9.9% |

| $25 | $1.49 | 5.96% |

| $50 | $1.99 | 3.98% |

| $75 | $2.99 | 3.99% |

| $100 | $3.84 | 3.84% |

| $200 | $7.67 | 3.84% |

Yowsa. At nearly 4% at the low end, that’s a strong headwind.

I noticed some trades held the lower fee, even though the trade amount crossed over into the next tier. The mechanics seem a bit slushy, but this beginner-friendly box provides big fees for Coinbase.

There’s also a spread, a padded price used by many exchanges to lock in a price. You’re not interacting directly with the order book, so Coinbase quotes a price that includes a spread.

If you want to save on Coinbase trading fees, you can use Coinbase Advanced, which doesn’t use a spread and offers much lower fees.

Pro tip: Leave that box alone.

However, the Buy & Sell box does offer repeat buys, something you can’t do with Advanced. You can set up an automatic purchase of BTC, ETH, or other cryptos to dollar-cost average your position. It’ll cost ya, but you can do it.

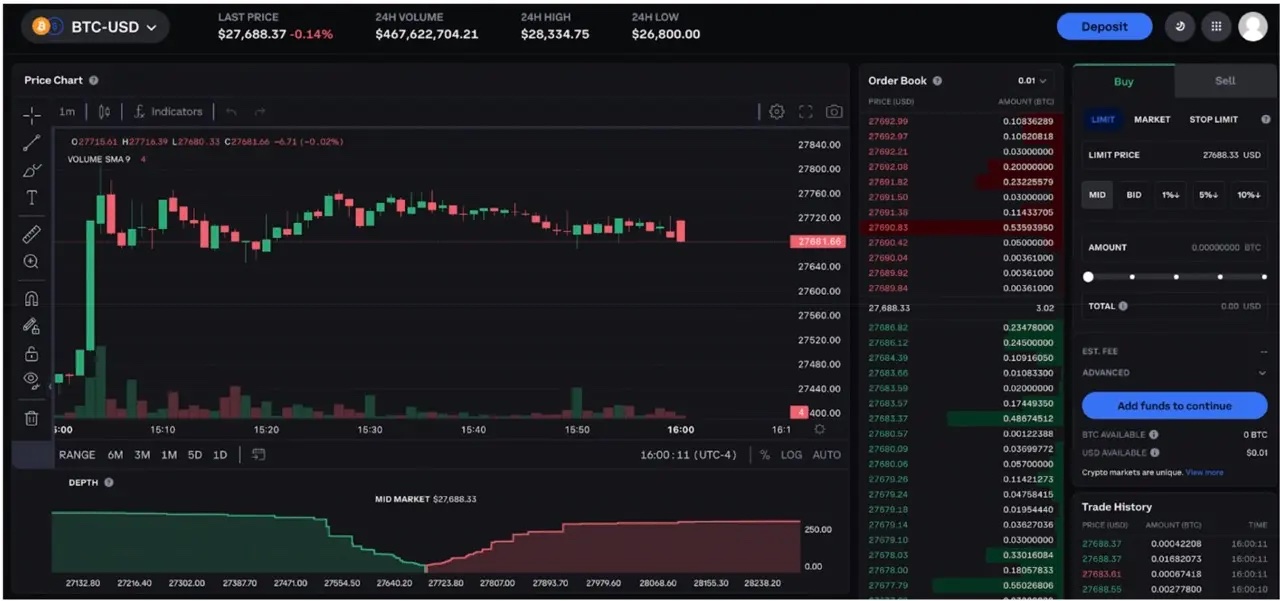

Coinbase Advanced

Back in the day (2022), Coinbase had a separate exchange called Coinbase Pro, which has now been replaced with Coinbase Advanced. Coinbase vs. Coinbase Pro vs. Coinbase Advanced can be confusing, so the distinctions deserve some attention.

The new Advanced trading brings the same lower fee structure traders enjoyed with Coinbase Pro but brings one big advantage: You don’t have to transfer funds to use the Coinbase Advanced. (Coinbase Pro made you shuffle your crypto between Simple and Pro.)

Coinbase Advanced gives you charts and indicators as well as a peek at the order book so you can see the buy and sell orders stacked up like rush-hour commuters trying to get through the Holland Tunnel.

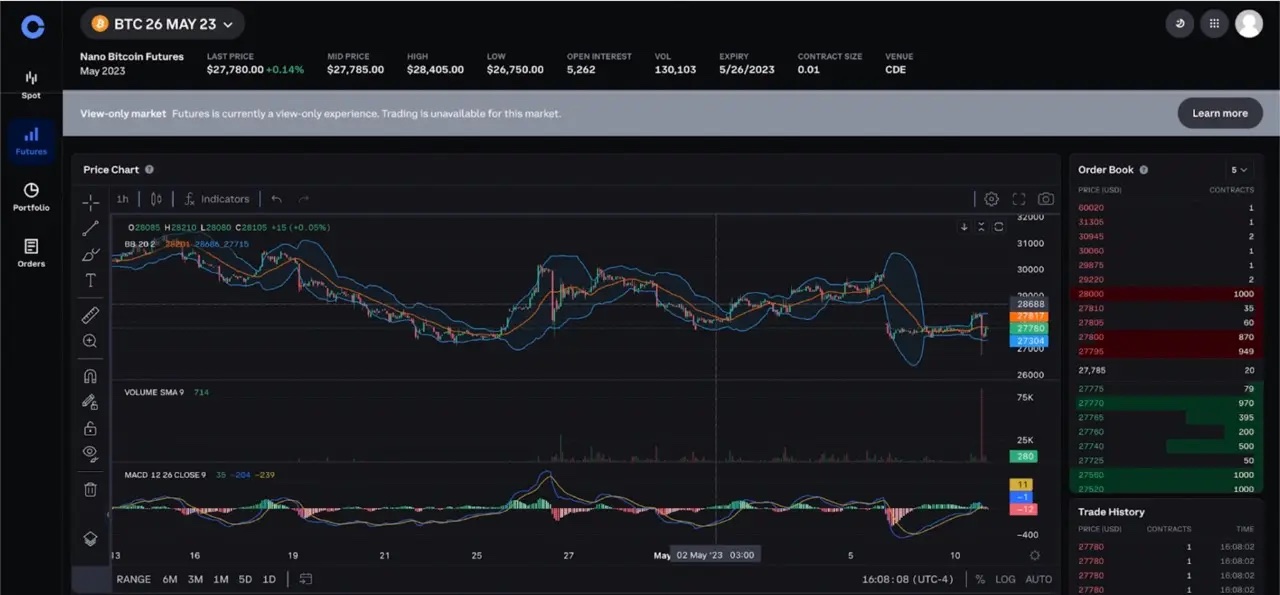

Advanced trading brings the features you’d expect, like limit orders and stop-limit orders. And if you live in a supported market (not the US), you’ll have access to futures trading. Coinbase also recently introduced Coinbase International for institutional traders in select jurisdictions.

I added MACD and Bollinger Bands as indicators, but you can choose dozens of others.

Fees are much lower for Coinbase Advanced compared to Simple trades. Advanced uses a tiered structure based on 30-day trading volume.

Coinbase Advanced Fees

| 30-Day Trading Volume | Maker | Taker |

|---|---|---|

| Less than $10k | 0.40% | 0.60% |

| $10k – $50k | 0.25% | 0.40% |

| $50k – $100k | 0.15% | 0.25% |

| $100k – $1m | 0.10% | 0.20% |

Etcetera, up to $400 million monthly trading volume.

The lowest cost tier ($400+ million 30-day trading volume) has 0% maker fees and 0.05% taker fees. Maker fees apply to limit orders because you’re “making” a market with your orders. Taker fees apply to market orders because you’re “taking” limit orders off the order book.

Even if you don’t qualify for the top tiers, Coinbase Advanced brings those trading fees back down to earth.

How To Use Coinbase Advanced

The simple buy & sell box featured throughout the Coinbase site is among the more expensive ways to trade crypto on Coinbase (or anywhere else). Learning your way around Coinbase Advanced pays steady dividends in the form of savings on every trade you make.

Let’s learn how to navigate the Advanced interface. It’s easier than the name implies.

To get to Advanced Trading. Click on the user icon on the top left of the screen.

![]()

Simple trading is enabled by default. Select Advanced instead. Then, continue.

![]()

![]()

The advanced interface looks, well, advanced. But it’s easier than it looks. Starting with a large chart in the middle of the screen, you can see trades executing and buy and sell orders stacked in the center column.

You’ll use the right column for buying and selling.

Pictured below is the spot market trading interface on Coinbase Advanced. Spot trading refers to immediate delivery. You buy it, and you receive it right away.

You’ll also see a tab for Futures, which isn’t available to retail traders in the US.

![]()

BTC-USD is the default trading pair when you open advanced trading. Trading pairs just mean you can trade this for that. USD is the most commonly paired currency. Coinbase Advanced also combines USD and USDC for trading purposes. So, if you have some USDC, a popular stablecoin pegged to $1 USD, you can trade it as if it were USD.

This account doesn’t have any USD, USDC, or BTC, but it has some ETH. Let’s say we want to get some BTC in exchange for ETH.

Hover over the BTC-USD trading pair icons and then click on BTC to see your available trading pairs.

![]()

ETH-BTC is right on top. Click that option to trade ETH for BTC.

Depending on what you need to trade, there may not be a supported pair. In this situation, you’ll need to make two trades: one from the crypto you have to USD and then another to the crypto you want to buy. It’s like when you can’t get a direct flight from Philly to Austin and need to change planes in Dallas. You’ll still get there.

Sell Vs. Buy With Coinbase Advanced

When using trading pairs, you’re selling one asset in the pair to buy the other. In this example, we have ETH we want to trade for BTC. So, we’re selling ETH to buy BTC.

Initially, Coinbase opened the buy tab, but we couldn’t buy with BTC because we don’t have any BTC in this account. Keep that in mind when making your trades. Sometimes, you’ll have to switch tabs to make your trade.

![]()

Limit Orders Vs. Market Orders On Coinbase Advanced

Coinbase uses maker and taker fees for advanced trading.

- Maker fees mean you’re making a market by adding orders to the order book with limit orders. You’ll pay 0.4% for maker fees if you trade less than $10,000 per month.

- Taker fees are higher at 0.6% at the same trading volume because you’re taking orders off the order book with a market order.

Although fees vary on other exchanges, the maker-taker fee model is common on crypto exchanges as well as stock trading. It’s likely to come up again in trading, so it’s helpful to understand how it works.

- Limit orders (maker) let you set the price for your order. These orders are added to the order book waiting for a match.

- Market orders (taker) are filled from the order book of limit orders. You can’t set the price. Instead, the price is based on the existing limit orders available in the order book. rather than price, market orders are based on amounts. For example, you want

Advanced Settings:

- Execution: By default, Coinbase allows limit orders to “allow taker,” which means all or part of the order may execute with a higher trading fee, depending on the price you choose. You might want to change this setting to “post only” to make it a standard limit order.

- Time in Force: By default, trades are set to “good til canceled,” meaning the limit order will sit indefinitely until a match is found. If the market moves away from that price range, the order might not ever execute. You can change this so the order expires at a certain time or set your order to “immediate or cancel” (this last option enables taker fees again).

Setting The Limit Order Price:

You can set the limit price for your order manually, but it’s easier to choose a ready-made option.

In the example below, we choose the ask price as the price for the order. You can see the price matches the ask price in the order book. You can also choose “MID,” meaning a mid-market price. Lastly, you can choose a fixed percentage above (or below on a buy) the market price.

ETH and BTC often move together in price, so we’ll avoid the percentage-based pricing for this trade.

![]()

Limit sell orders in the order book are highlighted in red. Green marks buy orders.

Trade Amount:

You can use the slider to set the amount of your order. In the example above, the order is set to half the ETH held in this Coinbase account. Alternatively, set an amount manually.

Choosing Market Orders On Coinbase Advanced:

To buy or sell at the market price, just choose the second tab on the right-hand column. Now, all the options you had with a limit order are gone. You can set the amount for your trade. That’s it.

![]()

Market orders are always easier than limit orders, but you don’t have the ability to fine-tune your order, and you’ll pay a bit more for the trade. Even so, using market orders with Coinbase Advanced is still more economical than using the simple Buy & Sell box (and almost as easy).

Coinbase Vaults

By default, Coinbase stores your crypto in a custodial wallet you can use to send and receive or trade on Coinbase’s simple or advanced platforms. But sometimes, it makes sense to keep some funds somewhere else.

When you go out on the town, you bring your wallet but leave the rest of your money in the bank. Same idea.

Coinbase vaults let you keep some funds in your main wallet, accessed through “My assets,” and set up a separate secure vault for a given asset (all Coinbase trading assets are supported). You can even send funds to your vault from outside Coinbase.

Good news: Coinbase vaults are free.

You can set the permissions for each vault, making it an individual or group vault. Then you can set the number of authorizations required to access the funds in the vault. For example, you might want two out of three members in a group as a requirement to authorize access. However, only the master account owner can request a withdrawal. Your bowling buddies can’t run off with your crypto.

Here’s how it works: Once you set up a vault and request a withdrawal, the request must be approved within 24 hours. If there’s no response, the withdrawal is canceled. Be sure only to use vaults with funds you won’t need in a hurry. After an authorization request is approved, there’s a 48-hour waiting period before the funds are released.

Coinbase Learning Rewards

Sometimes, when Coinbase launches new coins or tokens on the exchange, you’ll get an opportunity to earn free crypto by learning about the new token and completing short quizzes. In most cases, these provide $1 worth of the new crypto for each quiz you pass, with a max of $3 earned.

I used these quizzes to teach my son about crypto basics. Now, he has a crypto stack he’s adding to weekly. Nice touch, Coinbase.

Coinbase Staking

Generally, when you see a section of an exchange that uses the title “Earn,” it’s a clue to read the fine print. Often, the nebulous Earn moniker means they’re lending your crypto or using it as collateral. The good news is that Coinbase doesn’t do this, at least according to their SEC filing.

Instead, Coinbase offers two primary ways to earn a yield.

- Staking: You can use Coinbase to stake popular proof-of-stake cryptos like SOL or ETH. Coinbase even has liquid staking for ETH, which we’ll discuss in just a bit.

- DeFi Yield: Depending on your location, you may be able to use Coinbase to earn yields on decentralized finance applications (dApps) like Curve or Aave. In the US, where I am, it looks like a dead end.

Occasionally, Coinbase also offers what we’ll call promotional interest rates. For example, If I were to buy USDC stablecoin now, I’d earn 2% without staking or wandering off into DeFi-land.

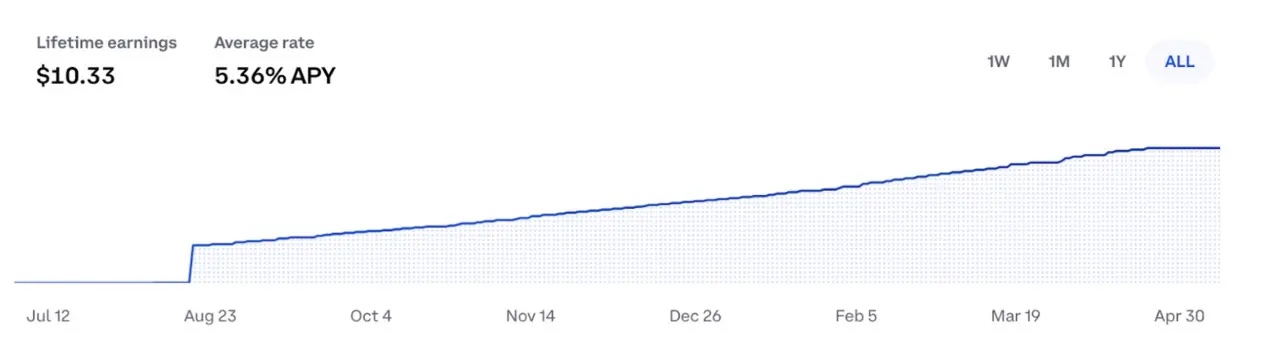

Staking looks to be the most reliable way to earn a yield on Coinbase. Let’s explore how it works.

Coinbase Staking Yields Vs. Binance.US

| Crypto | Coinbase Yield |

|---|---|

| ETH | 6.00% |

| ADA | 2.00% |

| SOL | 2.4% |

| ATOM | 6.12% |

| XTZ | 3.19% |

Like staking yields everywhere, yields fluctuate based on the network demands for each proof-of-stake blockchain. Check out our staking page for a detailed breakdown of how crypto staking works and various ways to earn a staking yield.

Coinbase makes staking easy, but there are fees at work in the background (reflected in the overall yield). These fees are a bit tough to track down and might even change. If you’re shopping for the best staking yield, just be sure the advertised rate includes any validator fees so you’re not comparing apples to pineapples.

Coinbase Liquid Staking

Coinciding with the Shanghai upgrade to Ethereum, Coinbase introduced a new staking method for ETH: liquid staking. Protocols like Lido pioneered the idea, and now exchanges like Nexo and Coinbase are bringing their own liquid staking tokens to market.

Staking ETH used to require an indefinite lockup. Your ETH was staked, and that was where it stayed. Shanghai changed that, but it’s still not always easy to unstake your ETH due to minimum staking requirements per validator (32 ETH). Liquid staking solves both problems by leaving the ETH staked and then issuing a new token that represents the staked ETH, still earning a yield.

Coinbase cbETH Token

Coinbase’s cbETH token is staked ETH that you can sell at a whim or use as collateral where supported, earning a yield until the cbETH changes hands. I had a small amount of ETH staked on Coinbase prior to the Shanghai upgrade and was able to swap my forever-staked ETH to liquid cbETH in just a few clicks.

Already, DeFi lending protocols, like Aave, support cbETH, letting you access the value in your staked ETH. Use it as collateral or earn an additional yield by supplying cbETH to a lending pool.

Coinbase Card

We covered the Coinbase Card on our crypto credit cards roundup, but it’s not a credit card at all. This Visa debit card provides two main features.

- Spend your crypto (or cash): Fund your card with crypto or cash (paychecks, bank accounts) and spend wherever Visa is accepted.

- Earn crypto rewards: Each month, Coinbase offers different rewards for spending, including Bitcoin and other cryptos.

For this transaction, I used USDC — a stablecoin pegged at $1 — to fund the card and avoid any capital gains taxes on the crypto I was holding. Under current crypto tax rules, I was hesitant to use ETH or BTC.

I earned 1.5% cashback, paid in Bitcoin. Cool. Thanks, Coinbase.

Coinbase Taxes

Crypto taxes are no fun, but Coinbase makes them easier — assuming you only use Coinbase for crypto.

Here’s a summary of my 2022 Coinbase transactions.

Yeah, I lost money. But on the upside, there were no taxes due.

With a standard account, you can download a CSV file you can import into TurboTax. With a Coinbase One account (up next), you can download a prefilled Form 8949.

However, if you trade on multiple exchanges or use DeFi, you’ll probably need specialized crypto tax software that pulls in the data from multiple exchanges or the blockchains themselves.

Coinbase One

Coinbase Advanced brings low-cost trading, but Coinbase One offers no-fee trading for up to $10,000 in trades per month. It’s a subscription service priced at $29.95 monthly with a 30-day free trial.

Free trading isn’t the only benefit.

- Free Trades: Trade all you want with no fees, up to $10,000 in monthly trading (after which fees apply).

- Boosted Staking Yields: Earn more when you stake. The current advertised rate for staking with a Coinbase One account is about 10% higher than the highest standard yield for staking.

- Priority Support: Reach a live person at Coinbase 24 hours a day, 365 days a year.

- Unauthorized Access Protection: You may be eligible for account protection of up to $1 million if someone gains unauthorized access to your Coinbase account.

Coinbase One isn’t a separate platform like Coinbase Pro was. You’ll use all the Coinbase features you’re accustomed to using but earn more and spend less doing so. For higher volume traders or people who stake larger amounts, the $30 monthly cost might make sense.

Coinbase Customer Service

There’s 24/7 phone support for Coinbase One subscribers, and standard users can call the Coinbase phone number at 1 (888) 908-7930 for assistance with locked accounts, questions about the Coinbase car, or other issues.

Alternatively, if you don’t want to wait on hold, you can contact Coinbase through an email ticket system or a chat box on the support page. I’ve used both online support methods before when working on the Coinbase Wallet review and was able to get a speedy answer to my questions.

An FAQ page also offers walkthroughs for common Coinbase exchange questions.

Who’s Coinbase For?

Coinbase focuses its business on core customers, building a loyal customer base while staying within the company’s expertise.

- People Who Are New To Crypto: Coinbase does an admirable job of onboarding crypto newbies. You’ll find plenty of help pages and guides if you’re not sure what to do next.

- People Who Value Safety In Crypto Trading: As a publicly traded company, Coinbase’s financials are bare to see, whereas many other exchanges (like FTX) are a black box — or were a black box in FTX’s case. The exchange collapsed in 2022. Coinbase also keeps the majority of user funds in cold storage.

- People Who Trade Common Crypto Assets: Coinbase’s crypto selection continues to grow, but there are still many cryptocurrencies you won’t be able to trade on Coinbase, including XRP and Tron. But if you’re more of a blue-chip crypto buyer, you’ll find plenty of trading liquidity in the established cryptos.

Additional Coinbase Features

- Coinbase Wallet: Available as a Chrome web extension or a mobile app for Android and iOS, Coinbase Wallet is one of our top picks for DeFi on Ethereum and compatible blockchains. The mobile app also supports Bitcoin. The Coinbase Wallet can be used with or without a Coinbase account.

- Coinbase Web3 Wallet: The Coinbase app also comes with a “web3” wallet, meaning it’s built to interact with DeFi applications. This feature is not yet available for all users and only works fully on mobile; desktop users get a read-only version that can’t transact.

- Borrow Against Bitcoin: Use your Bitcoin stack to borrow cash with up to 40% LTV. Interest rates for borrowing currently come in under 9%.

- Coinbase Mobile App: Perform all the trades and staking activities you use on the desktop on the go with the Coinbase app. It’s available for iOS and Android.

How To Buy Bitcoin On Coinbase

Earlier, I showed you the fees for the simple trade box. Those fees are high. Let’s walk through how to use Coinbase Advanced instead so that you can buy more Bitcoin for your money — and let’s do it on the Coinbase app (mobile).

Step 1: Deposit Some Money Or Crypto.

Look for the hamburger menu in the top left of the Coinbase app and select “Add cash.” Follow the instructions to add cash from your bank account or PayPal.

Alternatively, you can transfer crypto to Coinbase. For example, you can transfer USDT (Tether) from another exchange or wallet. Check to be sure there’s a BTC trading pair with that asset on Coinbase, however, or you’ll need to make multiple trades. USDT/BTC is a pair on Coinbase.

Step 2: Select Advance Trade.

The fees for buying crypto with the standard interface are higher, so you’ll want to use the Advanced Trading platform. If you think you might need a hand, Coinbase offers tutorial links on the Advanced Trade screen.

Step 3: Select BTC.

From the trading pairs listed or from the search box, look for BTC. Choose your trading pair and then click “Buy.”

Step 4: Decide If You Want A Limit Buy Order Or A Market Buy Order.

Limit orders let you set your own price, whereas market orders buy at whatever price other traders offer, filling your order from the highest-priced limit orders first. Limit orders have lower fees, but they might take longer to fill.

Step 5: Choose Your Buy Amount And Confirm.

On the same screen, choose your buy amount and then preview your buy order. If it looks correct, confirm the purchase.

What Is Coinbase International?

Coinbase is well known for spot trading and staking popular assets like ETH. But many advanced traders want access to crypto perpetual trading, the ability to go long or short on cryptos without ever taking ownership of the tokens. Coinbase International Exchange answers the call bringing crypto derivatives trading to institutions worldwide — well, except for the US (write your congressperson).

Individual traders aren’t eligible yet, but Coinbase plans to onboard qualified traders later this year.

To start, Coinbase launched perpetual markets for BTC and ETH, the two largest cryptos by market cap (and often by trading volume). A massive exchange like Coinbase offering perpetuals should lead to well-balanced perpetual contracts that closely track the real-world price and let you trade with laser-guided precision.

Initially, expect leverage of up to 5x, letting you multiply your gains while reducing the risk found with higher-leverage markets. Liquidity for Coinbase International perpetual futures contracts is provided by external market makers.

Note: At this time, Coinbase International is only available to approved non-US institutions in jurisdictions where permitted.

Coinbase Alternatives

Coinbase Vs. Robinhood

Robinhood is better known for fractional stock shares, but the company offers popular cryptos as well.

| Exchange | Trading Fees | Notable Features |

|---|---|---|

| Coinbase | $0.99 up to $2.99 (up to $75 trades), variable above $75 + spread, 0.4% maker and 0.6% taker fees on Coinbase Advanced | Simple or advanced trading Crypto staking, including liquid ETH staking Cold storage and 1:1 backing of assets 250+ cryptos |

| Robinhood | No fees on crypto trades | 18 cryptos, including BTC and ETH Trade stocks, ETFs, and crypto through the same account $1 minimum order |

Coinbase Vs. Crypto.com

Crypto.com offers a wide selection of coins and tokens (250+). Many of the exchange’s benefits revolve around Crypto.com’s own CRO token, which can be staked to earn higher rewards with the Crypto.com credit card and higher yields on supported cryptos.

| Exchange | Trading Fees | Notable Features |

|---|---|---|

| Coinbase | $0.99 up to $2.99 (up to $75 trades), variable above $75 + spread, 0.4% maker and 0.6% taker fees on Coinbase Advanced | Simple or advanced trading Crypto staking, including liquid ETH staking Cold storage and 1:1 backing of assets 250+ cryptos |

| Crypto.com | 0.0750% maker and 0.0750% taker fees up to $250,000 monthly trading volume, additional discounts for higher volume | Multiple ways to earn yields Crypto rewards credit card 250+ cryptos |

Is Coinbase Safe To Use?

Coinbase advertises itself as the most trusted crypto exchange. That’s likely true, and the tagline is backed by a number of Coinbase security measures and features.

- Two-Factor Authentication (2FA): Get text and email confirmations before accessing your account.

- Coinbase Vaults: Your standard account on Coinbase is a crypto wallet secured by your login credentials, but you can also activate vaults on Coinbase that move your crypto to another wallet that restricts withdrawals to one or more specific users. Unapproved withdrawal requests are automatically canceled.

- 1:1 Crypto Asset Backing: Exchanges like FTX highlighted the importance of knowing how your crypto is being used by the exchange. To their credit, Coinbase doesn’t use your crypto at all. They store it. You trade it, HODL it, or stake it. Coinbase charges fees for some of those things you do with your crypto. That’s the entire business relationship in a nutshell.

- Public Financial Records: Coinbase is the world’s largest publicly traded crypto exchange. If you need financial information on the company, you’ll find what you’re looking for in the SEC filings.

- FDIC Pass-Through Insurance: Your cash deposits on Coinbase are insured up to $250,000 per account with FDIC coverage made available through Coinbase’s partner banks.

Coinbase also employs a number of other security measures, including cold storage, dark web scanning for potentially compromised login credentials, and more. But no exchange is 100% safe. Centralized exchanges bring some unique risks.

- Bankruptcy Risks: The collapse of FTX taught us that your crypto held on an exchange may or may not be your crypto if the exchange becomes insolvent. The bankruptcy cases for FTX, Celsius, BlockFi, and now Bittrex could drag on for years, leaving many investors wondering whether they’ll ever get their crypto held on the exchanges.

- Illiquidity Risks: Centralized exchanges can pause or halt withdrawals for a number of reasons, including illiquidity, meaning something went wrong, and now there just isn’t enough crypto to support markets and withdrawals. Perhaps just a temporary inconvenience, or perhaps something more, but the end result is that you may not have access to your crypto when you need it.

Is Coinbase legit? Yes, and arguably more so than other, more opaque exchanges. Is Coinbase safe? Probably, although there are always potential risks to consider.

To Sum It Up

Coinbase makes a solid choice for newer crypto investors — but at the same time, we’re disappointed with the fee structure for using the Buy & Sell box new investors are most likely to use. The solution, of course, is to use Coinbase Advanced to reduce trading fees.

In our Coinbase review, we found this beginner-friendly exchange still comes with a learning curve. The good news: on both the web app and mobile Coinbase app, you’ll find plenty of help along the way in the form of tips and articles.

Frequently Asked Questions

Coinbase is the largest publicly traded crypto exchange in the world. This gives users the tools they need to research the exchange before transferring a penny to Coinbase. Coinbase’s SEC filings make the company’s financials an open book. No company can be trusted 100%, but it’s helpful to know you have the tools to make an educated decision before investing or transferring funds to Coinbase.

Coinbase provides a welcoming experience for beginning crypto investors. Coinbase offers a number of ways to get started with crypto investing, including bank transfers or funding your account through PayPal. The exchange also offers a select group of cryptos, avoiding some of the newer or hype-driven cryptocurrencies.

You can withdraw from Coinbase in two primary ways:

- Withdraw to your bank account, debit card, or PayPal. (Not all debit cards support withdrawals.)

- Transfer your crypto to a self-custody wallet.

To withdraw, select your cash balance under the “Assets” tab and follow the instructions.

Sure. If you time your trades well or simply hold assets until they are profitable, you can make money with Coinbase. Trading fees are higher than you can find on some other exchanges, but even the highest fee tiers on Coinbase are often less than the weekly price movements in assets like ETH and BTC. Both market timing and time in the market play larger roles than trading fees in many cases.

Coinbase doesn’t take any account actions you don’t authorize. This means they don’t debit your bank account unless you or someone who has access to your account initiates the transaction. As a KYC (Know Your Customer) exchange, Coinbase takes the required steps to verify the identity of every user.

Centralized exchanges make an attractive target, but most of the crypto held for users is held in cold storage, which makes “hacking” the funds improbable. Cold storage means the private keys that control the wallet have never touched the internet. A larger risk is at the user level, where login credentials may be compromised. Coinbase routinely scans the da

Coinbase uses pass-through FDIC insurance from its partner banks. This insurance, up to $250,000 per account, is only available for cash balances and does not insure crypto assets like BTC or ETH.

Nasdaq investors own Coinbase (NASDAQ: COIN). Coinbase is the largest publicly traded crypto exchange in the world and went public in April 2021. Since its IPO, the Coinbase price has fallen considerably but has outperformed QQQ, an index that tracks the Nasdaq market, by more than 3 to 1 in 2023.